As we step into 2025, the landscape of cryptocurrency mining continues to evolve at a breakneck pace. The burgeoning market has seen a plethora of new mining machines, hosting solutions, and digital currencies emerging, each with its own set of features and benefits. Choosing the right mining equipment has become vital for both newcomers and seasoned miners, especially in a world dominated by Bitcoin, Ethereum, and other cryptocurrencies.

The first consideration when selecting mining equipment is often the type of cryptocurrency you aim to mine. Bitcoin (BTC) remains at the forefront, driven by its demand and market value. Consequently, Bitcoin miners often require specialized mining rigs, typically ASIC (Application-Specific Integrated Circuit) machines, designed solely for optimal Bitcoin hashing. The efficiency and speed of these miners can significantly impact profitability, making them a wise investment for those looking to dive into Bitcoin mining.

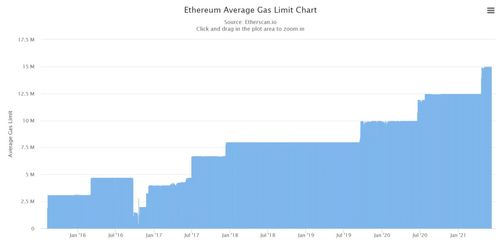

On the other hand, Ethereum (ETH) presents a unique scenario. As it transitions from Proof of Work (PoW) to Proof of Stake (PoS), miners are left pondering the longevity and viability of their mining rigs. GPUs (Graphics Processing Units) hold the current advantage in Ethereum mining, providing versatility for other altcoins, too. With Ethereum’s fluctuating prices and network changes, assessing the current mining environment is crucial before committing to expensive GPU setups.

Now, let’s delve into the nuances of mining machine hosting. With operational costs soaring, many miners opt to host their equipment in dedicated mining farms. This strategy not only mitigates the challenges of cooling and electricity consumption, but it also maximizes uptime and potential earnings. A reputable hosting provider will ensure your machines run at optimal levels, promising better returns on your investments while alleviating the technical headaches typically associated with home setups.

Yet, the choice of a mining machine hosting facility isn’t merely about cost efficiency. Factors such as location, energy source, and security should weigh heavily in your decision. A facility powered by renewable energy could be particularly appealing, ensuring a lower carbon footprint while also yielding cost savings. Additionally, security measures like CCTV, fire protection, and robust physical barriers can safeguard your investments against theft and operational disruptions.

In the ever-changing world of crypto, new currencies such as Dogecoin (DOGE) have garnered significant attention. Initially created as a meme, it has now transcended its playful origins to become a legitimate currency embraced by a vibrant community. Mining Dogecoin effectively requires a different approach, particularly since it operates on a Scrypt algorithm, often making it suitable for miners using GPUs. This key detail opens up diverse opportunities for miners looking to diversify their portfolios with less mainstream but promising cryptocurrencies.

When considering which mining rigs or hosting options to pursue in 2025, be mindful of the rising energy costs and regulations associated with cryptocurrency mining. More jurisdictions are implementing stricter environmental codes. The focus on sustainability means that miners must adapt to eco-friendly practices, whether through energy-efficient equipment or renewable sourcing for their operations. Paying attention to these factors today will not only ensure compliance tomorrow but also enhance your marketability as a miner in an industry increasingly sensitive to environmental concerns.

Furthermore, staying updated with exchanges and how they support the currencies being mined is crucial. The efficiency of converting your mined coins, whether Bitcoin, Ethereum, or Dogecoin, is directly tied to the exchanges you utilize. Low fees and high liquidity on exchanges can make a significant difference in realizing profits from your mining endeavors, thereby influencing which cryptocurrencies you choose to focus on.

In conclusion, the right choice of mining equipment in 2025 hinges on a multivariate assessment of your goals, the cryptocurrencies in question, and the associated operational conditions. By carefully analyzing Bitcoin and Ethereum’s mining requirements, embracing hosting solutions, diversifying into trending coins like Dogecoin, and remaining attuned to fluctuations in the market and regulations, you position yourself optimally within this exciting and dynamic field. As the journey continues to unfold, be prepared to adapt, evolve, and harness the full potential of your mining investments.

Leave a Reply