The crypto landscape of 2025 is a swirling vortex of opportunity and peril, especially for those venturing into the hardware-intensive world of mining. Bitcoin’s maturity, Ethereum’s evolution (or perhaps a successful transition, depending on which fork you ask), and the ever-present allure of altcoins like Dogecoin mean that selecting the right mining machine is less a simple purchase and more a strategic imperative. The wrong choice can sink you faster than a broken ASIC in a flooded mining farm. Are you ready to navigate the labyrinth?

The first, and perhaps most crucial, pitfall is chasing hash rate without considering energy efficiency. In 2025, electricity prices are unlikely to decrease. In many regions, they’re more likely to surge. A machine boasting astronomical hash rates might seem tempting, but if it consumes power like a small city, your profitability will evaporate faster than a block reward halving. Don’t be seduced by the siren song of raw power; demand detailed efficiency metrics (J/TH – Joules per Terahash) and compare them rigorously across different models. Furthermore, scrutinize the power supply unit (PSU) – a cheap PSU can negate the efficiency gains of an otherwise well-designed miner.

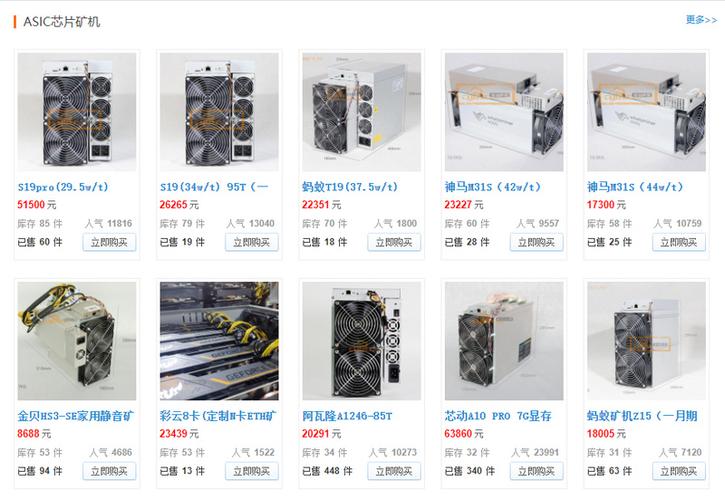

Ignoring the algorithm is another cardinal sin. Bitcoin mining remains dominated by SHA-256 ASICs, specialized chips designed for that specific task. Ethereum, even if proof-of-stake fully prevails, might still have opportunities for mining other algorithms on its network or related chains. Dogecoin, often mined alongside Litecoin using Scrypt, presents a different hardware demand altogether. Buying a Bitcoin ASIC to mine Dogecoin would be like trying to hammer a nail with a banana – utterly futile. Identify the coins and algorithms you intend to mine *before* you even begin browsing hardware. Focus is key.

Overlooking the importance of cooling is a recipe for disaster. Mining machines generate immense heat, and inadequate cooling leads to reduced lifespan, decreased performance (due to thermal throttling), and increased downtime. In 2025, passive cooling is largely a relic of the past, except for very low-power setups. Liquid cooling and immersion cooling are becoming increasingly common, especially in large-scale operations. Factor in the cost and complexity of implementing and maintaining these advanced cooling systems when calculating your overall ROI. Don’t underestimate the importance of airflow and ventilation – a hotbox is a miner’s graveyard.

Falling for hype and marketing without doing your own research is a surefire way to get burned. The crypto world is rife with scams and over-promised technology. Be wary of manufacturers who make outlandish claims or lack a proven track record. Demand independent reviews, verifiable performance data, and a robust warranty. Scrutinize online forums and communities for user feedback. Remember, if something sounds too good to be true, it almost certainly is. Due diligence is your shield against charlatans.

Neglecting the long-term viability of the hardware is a critical oversight. Mining machines are not investments that appreciate in value. They depreciate rapidly, especially with the relentless pace of technological advancement. Consider the resale value of the machine after a year or two. Will it still be profitable to mine with it? Will there be a market for used machines? Factor depreciation into your profitability calculations. Furthermore, consider the availability of spare parts and repair services. A machine is only as good as its ability to be maintained and repaired.

Ignoring the regulatory landscape is a gamble with potentially severe consequences. Governments around the world are increasingly scrutinizing crypto mining operations, imposing regulations on energy consumption, noise levels, and environmental impact. Ensure you are compliant with all applicable regulations in your jurisdiction. Failure to do so can result in fines, legal action, and even the shutdown of your mining operation. Stay informed about evolving regulations and adapt your strategy accordingly. A proactive approach is far better than a reactive one.

Forgetting about hosting fees and infrastructure costs is a common mistake. Unless you have access to cheap electricity and a suitable environment, you’ll likely need to host your mining machines in a dedicated facility. Hosting fees can vary significantly depending on location, power costs, and service levels. Factor these fees into your profitability calculations. Furthermore, consider the costs of setting up and maintaining your own infrastructure, including networking equipment, security systems, and backup power. These hidden costs can quickly erode your profits.

Finally, underestimating the importance of diversification is a risky strategy. Putting all your eggs in one basket – whether it’s a single coin, a single machine, or a single hosting provider – increases your vulnerability to market fluctuations, technical failures, and regulatory changes. Diversify your portfolio of coins, your hardware, and your hosting arrangements to mitigate risk. Explore different mining algorithms and consider investing in multiple types of mining machines. A diversified approach is a resilient approach.

Leave a Reply