In recent years, the landscape of cryptocurrency mining has undergone seismic shifts, particularly in the United States. As global demand for Bitcoin continues its relentless ascent, so too does the appetite for efficient, cost-effective mining rigs. These sophisticated machines, designed to solve intricate cryptographic puzzles and verify blockchain transactions, have traditionally represented significant capital investments. However, current market dynamics are unveiling unprecedented savings opportunities for Bitcoin mining rigs in America.

Bitcoin mining is not merely a game of computational power; it’s a strategic race influenced by hardware efficiency, electricity costs, and operational logistics. American miners are increasingly capitalizing on advancements in mining rig technology, combining these innovations with hosting services that promise optimized performance while mitigating the challenges associated with managing physical hardware. This synergy leverages cloud-hosted mining and colocation data centers, allowing miners to outsource energy-intensive operations while retaining control over their assets.

Mining rigs, particularly the latest ASIC (Application-Specific Integrated Circuit) models, have dramatically improved in hash rate and energy consumption ratios. Companies specializing in these devices are now offering competitive pricing, driven by surplus inventory and evolving manufacturing processes. For American entrepreneurs venturing into cryptocurrency mining, this equates to reduced upfront expenditure, enhanced long-term returns, and more agile responses to volatile market conditions.

But it’s not just Bitcoin that’s driving the mining machine market; Ethereum’s transition to proof-of-stake has redefined its mining landscape, pushing traditional rigs toward alternative cryptocurrencies or repurposing for hosting purposes. Miners are exploring Ethereum Classic, Dogecoin, and other altcoins, diversifying portfolios and optimizing their rigs’ utility. This trend epitomizes the fluidity of the mining sector, where adaptive strategies can unlock new revenue streams.

Hosting mining machines in America has emerged as a pivotal solution to the challenges of electricity costs and infrastructure maintenance. Mining farms equipped with renewable energy sources, such as hydroelectric and solar power, are gaining prominence, enabling miners to slash operational expenses and Carbon footprints simultaneously. These facilities, often located in regions with favorable energy policies, exemplify how environmental considerations align with economic incentives.

The rise of mining farms underscores an important shift: the decentralization of mining operations moving from private setups to industrial-scale centers. These farms not only provide robust security, cooling systems, and constant power supply but also constitute strategic hubs that facilitate rapid hardware deployment, firmware updates, and performance monitoring. For prospective miners, engaging with these hosting services offers a comprehensive approach to scale their cryptocurrency operations seamlessly.

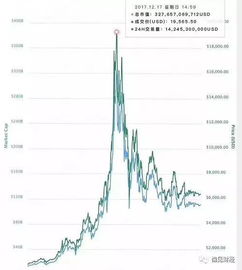

Of course, the viability of mining ventures is intricately linked to the fluid world of cryptocurrency exchanges. Price volatility on major platforms such as Coinbase, Binance, and Kraken can influence mining profitability significantly. Savvy miners monitor trends to time hardware purchases and optimize sell points for mined coins. Furthermore, exchanges facilitate the quick exchange of BTC, DOGE, ETH, and other tokens, enhancing liquidity and providing gateways for miners to convert computational efforts into tangible returns.

Integral to this ecosystem is the role of miners—the individuals or entities that deploy and operate mining rigs. Their expertise spans hardware configuration, cooling solutions, and network optimization, ensuring steady hash power feeds into the blockchain. The evolution of mining software, combined with AI-driven analytics, equips miners to anticipate system faults, preempt downtime, and maximize uptime. Mining is thus increasingly a blend of technical prowess and strategic foresight.

The American market’s current emphasis on efficient, affordable mining rigs and hosting solutions is a response to global disruptions and regulatory pressures. As nations recalibrate their stances on cryptocurrency, the U.S. industry leverages innovation and infrastructure advantages, reinforcing its position as a mining powerhouse. Entrepreneurs who invest in the latest equipment and integrate hosting services stand to reap sizable benefits, marrying cost reduction with scalability.

In conclusion, the confluence of advanced mining rig availability, inclusive hosting options, and a robust exchange ecosystem has stirred a fertile environment for Bitcoin mining in America. The newfound savings open doors for diverse participants—from individual enthusiasts to large-scale operations—fueling the growth of a dynamic, resilient crypto mining sector. Whether tracking the ascent of BTC, exploring altcoins like DOGE and ETH, or navigating the intricacies of mining farms, the opportunities for innovation and profit are expanding rapidly and unevenly, mirroring the very nature of blockchain technology itself.

Leave a Reply